According to the latest customs data, lead concentrate imports reached 134,800 mt in physical content in August 2025, up 10.23% MoM and 15.22% YoY. By the end of 2024, cumulative lead concentrate imports totaled 927,700 mt in physical content, an increase of 28.18% compared to the same period last year.

Additionally, silver concentrate imports for the same month amounted to 185,000 mt in physical content, up 20.01% MoM and 17.24% YoY.

In terms of country distribution, the US, Russia, and Peru were the main suppliers of lead concentrates that month, collectively accounting for over half (50.8%) of the total imports.

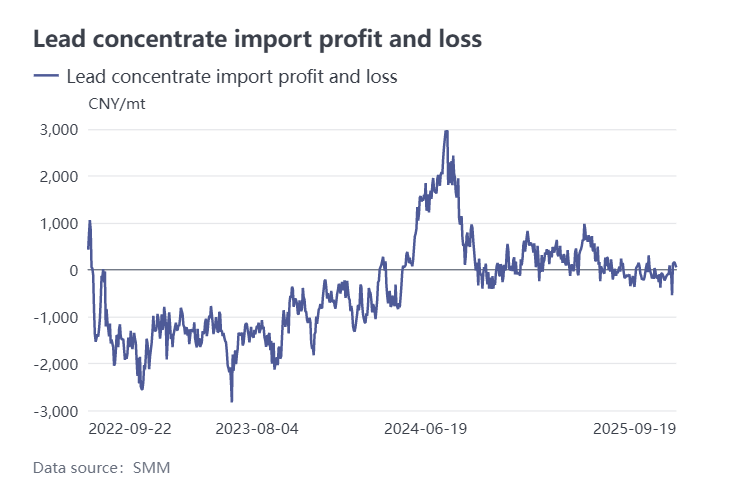

Regarding import profit margins, the import window for lead concentrates remains closed, indicating that imports are still at a slight loss. Nevertheless, orders for lead concentrates from the US arrived as scheduled from August to October. It is worth noting that imported ore resources circulating in the market have been relatively scarce recently, creating a situation where prices exist but transactions are limited. In particular, tender prices for forward-arrival lead concentrates have declined rapidly, with prices for some mid-to-low silver-content polymetallic lead ores even falling to between -$160 and -$170/dmt. However, against the backdrop of expectations for continued strength in precious metal prices, additional income from by-product sales can partially offset the cost losses caused by lower TCs. Meanwhile, as domestic smelters started winter stockpiling early, raw material inventory replenishment activities showed no significant slowdown even during the peak maintenance period in September, leading the lead concentrate market's supply-demand relationship to tighten toward a balanced state again.

According to industry analysis, lead concentrate TCs are not expected to see a significant rebound in Q4. If precious metal market prices continue to fluctuate at highs in 2026, TCs for domestic and overseas silver-rich lead concentrates may be further reduced, given that the silver payable indicator has already reached a historical high.